What is money disorder

Brad Klontz, a professor of psychology, says Disordered Money Behaviors: Development of the Klontz Money Behavior Inventory, that any financial behavior that leads to destructive consequences can be considered a money disorder. In other words, you are not just earning less than you could, but you are doing things that seriously affect your life, health, relationships with loved ones and career.

In the United States, money disorders can be found in the Diagnostic and Statistical Manual of Mental Disorders, a classification of mental illnesses created by the American Psychiatric Society. But in Russia such a diagnosis is not made. Unless a person suffers from one of the types of money disorder - gambling addiction, it can be found in ICD-10 under code F.63.

At first glance, it may seem that the symptoms of money disorder are only squandering or, conversely, hoarding.

But in reality they are much more diverse. Here are the signs identified by psychologists for Disordered Money Behaviors: Development of the Klontz Money Behavior Inventory:

- You don't like talking about money. You don’t admit to anyone that you have problems, and prefer even to tell your loved ones that everything is fine.

- You suddenly find yourself spending significantly more or significantly less than before. However, there are no objective reasons for such changes.

- You abuse credit cards. For example, you systematically pay with them even for basic purchases like groceries. Or you apply for a new credit card to pay off the debt on the old one. This behavior suggests that you have been ignoring your problems for quite some time and now they have acquired a dangerous scale.

- Thinking about money makes you feel anxious and depressed.

- You get irritated or, on the contrary, withdraw into yourself when they try to talk to you about finances.

- You have suddenly lost weight or, on the contrary, gained weight. You constantly feel tired and have trouble sleeping.

- You work much more than usual, stay in the office late, take work home. You can’t relax and unwind, you constantly feel the need to get even more money.

- You can hardly force yourself to spend money even on really necessary things and after each trip to the store you get upset for a long time.

- You often make impulsive purchases beyond your means and then feel guilty afterwards.

Is it possible to quit gambling?

Yes, you can, but if you are very addicted, it will not be so easy to do. The whole problem is in us, and here there will be a struggle with ourselves. But it is necessary not to fight the problem, but to accept it, or rather to find the cause and eliminate it.

If you have a severe case, I recommend that you still work through this problem with a psychologist, identify the destructive program that you laid down for yourself in childhood and change it to a positive one. To do this, write to me in the My Services section.

✅Guide to changing yourself .pdf

It’s easier to say, if you don’t have the willpower to give up a negative problem and deal with it yourself, then it’s better to work through the problem with a psychologist, it will be faster and less expensive. In short, anyone can change their life.

What are money disorders?

Experts combine all manifestations of money disorders into several groups.

Compulsive spending

That is, a painful addiction to shopping and an irresistible desire to go shopping. This condition is also called shopaholism, and 5 Patterns of Compulsive Buying affects about 6% of people. Before making a purchase, a person feels uplifted and inspired, and when the money is spent, he feels immensely guilty and depressed.

Hoarding and extreme saving

Here the situation is exactly the opposite. A person is obsessed with the idea of accumulating as much money as possible and at the same time is terrified of spending even a penny. In the most severe cases, such pathological hoarders, having impressive sums in their accounts, sleep on a bare mattress and rummage through garbage dumps. Like the American Kei Hashimoto, who lives on a fairly decent income. How does a woman live who spends 900 rubles a month on food for about $15 a month.

Workaholism

There are probably a couple of people around you who proudly call themselves workaholics and consider this a positive quality. But real workaholism is a pathological condition due to which a person becomes obsessed with work and earning money. Work becomes a real addiction, and those who suffer from it overload themselves, cannot rest and constantly experience anxiety.

Gambling addiction

It is also gambling addiction, or pathological attraction to gambling. This diagnosis has been known for a long time and there is even a BRIEF REVIEW OF VIEWS ON GAMING ADDICTION in ICD-10. A person develops a painful need to constantly participate in gambling, on which he, of course, spends all his own and sometimes other people’s money.

Financial lies

A person deceives loved ones, provides them with incorrect information about his income, loans, savings and expenses. Because he is afraid of being judged and when talking about these topics he feels strong discomfort.

Overprotectiveness

This story is typical mainly for very wealthy people. It happens that they shower their loved ones and children with money, immediately rush to solve any of their problems - even if no one asked for it - and as a result do not allow them to take the initiative and learn to earn money on their own.

Financial dependence

The opposite situation. Due to fears or immaturity, a person does not earn money himself (although he may well do so) and completely shifts the responsibility for his provision to someone else. For example, to a spouse or parents. This does not apply to cases where the family has consciously decided that one works and the other looks after the house and children.

Financial indiscretion

Sometimes this behavior is even called financial abuse Financial Incest: The Behavior That Can Set Kids Up For A Life Of Money Issues. The point is that parents involve their children in their financial problems and provide information that, due to their age, they do not yet need to know. For example, they constantly complain about a lack of money, admit that they may be fired, or ask the child to communicate with debt collectors. Since children in this situation are completely helpless and cannot earn money themselves, after such requests and statements they experience severe stress and do not feel safe.

Negation

A person simply ignores all his financial difficulties and pretends that they do not exist. Because thoughts about problems are too painful for him. In some cases, such “deniers” throw away accounts without reading and reject calls from the bank.

nothing24 – spent $16,000

I've never liked the Final Fantasy series.

In December 2020, Square Enix added the iconic Cloud from the seventh Final Fantasy to the mobile Final Fantasy: Brave Exvius. A few days later, a Reddit user named nothing024 admitted to spending $16,000 on the game.

Initially, he didn't plan to spend anything, but eventually he became annoyed at not being able to progress further in the game. He spent $20, which didn't seem like much. But this spark ignited a real fire.

Soon nothing024 was spending hundreds of dollars on the characters he wanted, paying for purchases with an interest-free credit card secretly from his wife. But when she took this card to buy groceries, the secret became clear.

Causes of money disorder

Settings

There is still an idea that money is something low and dirty, and that striving to earn more is unworthy.

People who believe in this believe that if something happens, an honest and spiritual person will definitely be helped by a higher power.

“God gave a bunny, he will also give a lawn” - something like that. Because of this approach, people do not know how to handle money, do not look for opportunities for additional income, and create many financial problems for themselves.

Upbringing

We often learn our attitude towards money from our parents. If the family kept financial records, carefully planned expenses, practiced reasonable savings and taught the child all this, the person will handle money wisely as an adult. And everything will be completely different if the parents were spenders, were always in debt and did not instill in their children the basics of financial literacy.

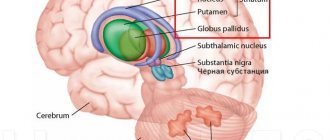

Mental illness

Inability to handle money, compulsive spending, addictions and denial of financial problems may well be manifestations of mental disorders. For example, depression or bipolar affective disorder.

Vince P. – spent $16,000

In November 2012, Wired published interviews with several whales about their spending habits and feelings about it. The range of reactions was the widest, from people completely disappointed in themselves to players like Panda, who said: “You don’t need to spend less, you need to earn more.”

But unlike Panda, the player who asked to be called only "Vince P." was very upset about his situation. He initially said he spent about $5,000 on a Facebook game called Battle Pirates. But during an interview via Skype, he checked his receipts, and the amount turned out to be more - $16,000.

“It just shocked me,” he said. “Such a sum, and all for nothing.”

How to get rid of money disorder

Since this is not a diagnosis, and it has quite a lot of variants and manifestations, each case requires its own approach. But there are also several universal recommendations.

Recognize the problem and try to solve it yourself

You will have to admit, at least to yourself, that your spending, debts, or, conversely, extreme savings can destroy your career, relationships, and family. And these problems also force you to constantly live in anxiety and stress, lie to loved ones, and run from debt collectors.

In the end, no one but you will correct this situation.

This means that you will have to analyze your financial situation, write down all loans and unreasonable expenses, think over a debt repayment plan and start keeping track of income and expenses. If this is too difficult to do on your own, it may be a good idea to contact a financial advisor. Yes, they exist in Russia too.

Walk 12 steps

In Russia there are several groups of anonymous debtors or anonymous spenders. They operate the Society of Long Aholics Anonymous based on the well-known 12-Step Programs for addiction recovery and, thanks to the mutual support of all participants, help overcome money problems and form healthy financial habits.

Ask for help

For example, tell everything to your loved ones who can listen and support you. Or contact a psychotherapist who will help you understand where your unreasonable spending, addictions and other problems are coming from. And at the same time, it will show you the path to financial and mental recovery.

Big Jim - spent $60,000

The hero of the article is on the left.

The 55-year-old electrical engineer, nicknamed Big Jim, spent about $30,000 on the relatively new game We Heroes, and has no regrets. In one of his interviews, he said that he also spent a comparable amount on Kingdoms of Camelot from Kabam.

But then he stopped playing it and boycotted Kabam games for its "unethical practice" of selling virtual items to players without disclosing the price. Sometimes it happens.

He doesn't seem particularly upset about spending money on games. But he still has a little regret about We Heroes - if it weren’t for this game, he would have had one more motorcycle. Everyone would have such problems.

Kevin Lee Ko – $1,000,000

Don't be distracted, pay!

And again Game of War. This game is famous primarily for its advertising with model Kate Upton . Critics do not like it, calling it “mediocrity” and “a vacuum cleaner for money.” But California's Kevin Lee Ko didn't care about their opinions. He loved this game very much.

In December 2020, he was found guilty of abusing his position at Holt to embezzle $4.8 million . In federal court in Sacramento, Ko said he used company loans to buy, among other things, season tickets to the San Francisco 49ers and Sacramento Kings, luxury cars, plastic surgery, furniture and golf club memberships.

However, the biggest purchase was not cars and yachts. In his confession, he claimed to have spent "approximately $1 million" on Game of War. Approximately 20% of all stolen money. The court sentenced him to 20 years in prison .

Bettysue Higgins - spent $166,000

It’s good that she didn’t know about the “Funny Farm” in VK.

It's not just young people and single bachelors who fall into the trap of microtransactions. In December 2011, Bettysue Higgins, 54, of Maine, was found guilty of embezzling $166,000 from her employer between 2006 and 2010.

She embezzled money by writing company checks for herself and depositing them into her personal account. Of the 220 fraudulent checks, 78 were spent on virtual currency in the Facebook games YoVille and Mafia Wars.

There is no exact data on exactly how much of the $166,000 was spent on games. But according to documents, in February 2010 alone, she spent more than 4 thousand dollars on games. The court sentenced her to 3.5 years in prison . According to her husband, he knew nothing about his wife’s hobby.

Yan Panasyuk – $335,000

Ian Panasyuk, a Boston programmer and Soviet émigré, purchased part of a virtual club called Neverdie for $335,000 , the most expensive virtual real estate deal in history.

The facility is located in the space game Entropia Universe and includes eight bio-domes, a space pier, a stadium, a club and a shopping mall.

It's all about profit. Entropia's economy is built on real money (game currency can be exchanged for real dollars at a fixed rate of 10:1), so virtual entrepreneurs can run a business in the game that generates real income.

The previous owner of the club earned $200 thousand a year . Panasyuk, whose name in the game is John Foma Kalun, has already drawn up a business plan for the development of the business and wants to surpass the results of the previous owner.